Course Overview O v e r v i e w

- Course Overview

- Course Outline

- What’s Included

- What You’ll Learn

CeMAP Course (Level 1,2 and 3) Overview

The CeMAP Course (Level 1, 2 and 3) provides in-depth knowledge of mortgage advice practices and the financial system of United Kingdom. It introduces learners to mortgage law, property-buying processes, and customer relationship management. The course explores how financial regulations and ethical standards guide professional mortgage advice.

Formal training helps learners prepare for CeMAP qualification while gaining real-world mortgage advisory skills. It strengthens understanding of compliance frameworks, enhances client communication, and builds the confidence to deliver accurate mortgage guidance.

At Training Deals, we deliver CeMAP training that is clear and accredited. Our experienced trainers simplify complex financial concepts through case studies and practical examples. With flexible learning support and expert-led sessions, we help you achieve CeMAP certification efficiently and confidently.

CeMAP Course (Level 1,2 and 3) Outline

Unit 1: Introduction to Financial Services Environment and Products

Module 1: Introducing the Industry, Regulations and Economics

Introducing the Financial Services Industry

Economic Policy and Financial Regulation

Module 2: Tax, HMRC and Benefits

in the United Kingdom Taxation I

in the United Kingdom Taxation II

State Benefits and HMRC Tax Credits

Module 3: Investment

Direct Investments - Cash and Fixed Interest Securities

Other Direct Investments

Collective Investments

Module 4: Products, Wrappers and Pensions

Tax Wrappers

Pensions

Module 5: Insurance and Assurance

Life Assurance

Health and General Insurance

Unit 2: in the United Kingdom Financial Services and Regulation

Module 6: Lending Types

Secured and Unsecured Lending

Secure Lending

Repayment Mortgage

Flexible Mortgage

Commercial Loans

Unsecured Borrowing

Module 7: Customers, Concepts and Advising

Customer Needs

Main Advice Areas

Legal Concepts

Module 8: Regulations, Regulatory Entities and Supervision

FCA's Aim and Activities

Regulating Firms and Individuals

Prudential Supervision

Conduct of Business Requirements I

Conduct of Business Requirements II

Consumer Credit

Anti-Money Laundering

Other Regulations Affecting the Advice Process

Consumer Rights, Complaints and Compensation

CeMAP Level 2: Mortgages

Unit 3: Mortgage Law, Policy, Practice and Markets

Module 1: Introductions to Mortgages, Types of Repayment and Clients

Role of Mortgage Adviser

Property and Mortgage Markets

Types of Borrowers

Schemes for Borrowers

Mortgage Repayment Methods

Other Mortgage Products

Repayment Vehicles

Unit 4: Mortgage Applications

Module 2: Property Process and Regulations

Mortgage Regulations

Principles of Mortgage and Property Law

Practical Aspects of Property and Mortgage Law

Overview on Buying a Property

Legal Aspects of Property Purchase

Module 3: Assessment of Suitability: Regulation and the Buying Process

Financial Status

Borrower's Credit Status

Suitability and Eligibility

Module 4: Lending and Property

Assessing the Property

Valuations and Surveys

Factors Affecting Lending Decision

Unit 5: Mortgage Payment Methods and Products

Module 5: Financial Planning, Protection and Advice

Financial Protection and Planning

Types of Financial Protection II

Pure Protection

Raising Additional Funds from Property

Unit 6: Mortgage Arrears and Post Completion Issues

Module 6: Post Mortgage Care

Mortgage Transfer

Arrears and Debt Management

Lenders' Legal Rights and Remedies

CeMAP Level 3: Assessment of Mortgage Advice Knowledge

Unit 7: ASSM

Case Studies

What’s included in this CeMAP Course (Level 1,2 and 3)?

- Expert-led Training Sessions by Certified Instructors

- Course Completion Certificate

- Digital Delegate Pack

What You’ll Learn in this Course

This course takes you from understanding financial regulations of United Kingdom to mastering professional mortgage advisory practices. Each stage builds strong technical knowledge and client-handling confidence.

Learn the fundamentals of United Kingdom financial services and mortgage regulations

Learn how to assess client needs and recommend suitable mortgage products

Learn to apply financial laws, ethics, and compliance standards in practice

Learn how to manage mortgage applications and lender communication

Learn to evaluate risks and provide sound financial guidance

Learn how to prepare effectively for CeMAP certification

Our Upcoming Batches

Request More Information

Corporate Training

Elevate your workforce with expert-led corporate training that enhances skills, boosts productivity, and aligns teams with your business goals.

Individuals Training

Unlock personal growth and sharpen professional skills with tailored training designed to build your confidence and career success.

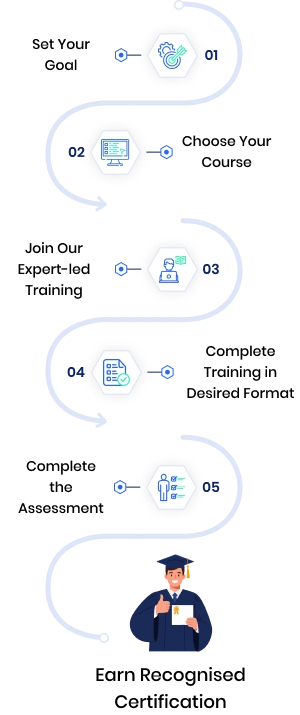

Your Path to Professional Recognition

Our path is designed to guide you through each stage with clarity, support and practical learning, helping you achieve your goals with confidence.

Step Forward with Globally Recognised Certification

A recognised certification is more than a credential. It’s proof of your commitment to professional excellence, providing you with the credibility, confidence, and global reach to advance your career in exciting new directions.

Globally Certified Professionals Over Time

Career Growth

81%Certified professionals reported receiving a promotion after earning their certification.

Global Opportunities

89%Certified professionals experienced access to new career opportunities, including leadership roles and global positions.

Not able to find what you are looking for

Our experts will guide you to the right course from thousands worldwide: tailored to your goals.

Frequently Asked Questions

It is a professional training course designed to prepare learners for the CeMAP qualification and careers in mortgage advice.

It helps learners gain FCA-recognised certification, enhancing credibility and employability in the United Kingdom financial sector.

It is ideal for aspiring Mortgage Advisers, Financial Consultants, or Professionals seeking to enter the mortgage and banking industry.

Yes, CeMAP knowledge applies to financial services, mortgage advisory, and related client-focused financial roles.

It equips learners with technical, ethical, and practical advisory skills required to provide professional mortgage guidance.

What Our Customers Say About Us

Matthew Sullivan

HR Business Partner

Matthew Sullivan

HR Business Partner

Our HR team registered for the Change Management Foundation & Practitioner Training Course, and it couldn’t have been more valuable. The team gained practical frameworks to guide employees smoothly through transitions with confidence.

Olivia Barrett

Operations Manager

Olivia Barrett

Operations Manager

Our operations staff completed the Lean Six Sigma Green Belt Training Course, and it has been transformative. We can now identify inefficiencies quickly, and the tools we learned are already improving performance across the team.

Benjamin Foster

Product Manager

Benjamin Foster

Product Manager

Our product team took part in the Agile Project Management Foundation & Practitioner (AgilePM®) Training Course, and the difference is remarkable. We’re now more adaptive, collaborative, and efficient in managing change.

Lucy Harper

IT Support Lead

Lucy Harper

IT Support Lead

Our IT support unit attended the ITIL® 4 Foundation Training Course, and the results have been impressive. Processes are smoother, collaboration has improved, and the team finally speaks a common language of service management.

Edward Clarke

Programme Manager

Edward Clarke

Programme Manager

We joined the PMP® Certification Training Course as a leadership group, and it was outstanding. The trainer made every concept practical, and the exam preparation resources helped the whole team feel ready to tackle complex projects.

Amelia Rhodes

Project Officer

Amelia Rhodes

Project Officer

Our project office completed the PRINCE2® Foundation & Practitioner Training Course, and it has brought real clarity to how we manage projects. The trainer’s examples were excellent, and the team now follows a structured approach with confidence.