Course Overview O v e r v i e w

- Course Overview

- Course Outline

- What’s Included

- What You’ll Learn

- Exam Details

MoR® 4 Practitioner Risk Management Certification Overview

The MoR® 4 Practitioner Risk Management Certification expands on foundational risk management principles, focusing on applying structured techniques across strategic, programme, project, and operational levels. It equips professionals with practical methods to identify, assess, and control risks while enabling confident, evidence-based decision-making in complex organisational environments.

Being formally trained at the Practitioner level allows professionals to translate MoR® principles into measurable outcomes. It enhances analytical thinking, supports proactive risk mitigation, and helps align risk management with business objectives. Certified practitioners demonstrate their ability to manage uncertainty effectively and drive organisational resilience.

At Training Deals, the MoR® 4 Practitioner Course is delivered by certified experts who combine theoretical frameworks with real-world applications. Learners benefit from practical exercises, scenario-based learning, and flexible study formats that ensure complete exam readiness and the confidence to apply MoR® principles in dynamic business contexts.

MoR® 4 Practitioner Risk Management Certification Outline

Unit 1: Understand the Purpose & Principles of Risk Management

Module 1: Describe Risk, Risk Management and Why Risk Management it is Used, Including the Difference and Relationship Between Risks and Issues

What is Risk and Risk Management?

Why Use Risk Management?

Module 2: Describe How Risk Management Supports Corporate Governance and Enterprise Risk Management, and Describe the Relationship Between them

Corporate Governance and Enterprise Risk Management

Module 3: Explain the Different Risk Management Challenges that a Product Orientated Organisation Faces

Challenges of Applying Risk Management

Module 4: Assess How Risk Management is Affected by Functional Orientated and Product Orientated Organisations

Functional- and Product-Oriented Operating Models

Module 5: Describe the Purpose of Principles and Why they need to be Applied in Risk Management

Overview of the M_o_R®4 Principles

Module 6: Apply and Analyse the Principles

Aligns with Objectives

Fits the Context

Engages Stakeholders

Provides Clear Guidance

Informs Decision-Making

Facilitates Continual Improvement

Creates a Supportive Culture

Achieves Measurable Value

Unit 2: Understand How Risk Management Applies within the 6 Perspectives

Module 1: Explain the Purpose of Risk Management in Each of the 6 Perspectives

Purpose of Risk Management in the Strategic Perspective

Purpose of Risk Management in the Portfolio Perspective

Purpose of Risk Management in the Programme Perspective

Purpose of Risk Management in the Project Perspective

Purpose of Risk Management in the Product Perspective

Purpose of Risk Management in the Operational Perspective

Module 2: Explain How and Why the Perspectives are Integrated

Integrating Risk Management Across the M_o_R®4 Perspectives

Overview of M_o_R®4 Perspectives

Escalation and Delegation

Aggregation

Module 3: Analyse the Calibration of Qualitative Scales Across Perspectives

Calibration of Qualitative Scales

Module 4: Apply the ‘Strategic’ Perspective and its Related Practices and Controls, including Integrating Risk Management Across Perspectives, and the Related Roles

Typical Roles in the Strategic Perspective

Related Practices and Controls in the Strategic Perspective

Module 5: Apply the ‘Portfolio’ Perspective and its Related Practices and Controls, including Integrating Risk Management Across Perspectives, and the Related Roles

Typical Roles in the Portfolio Perspective

Related Practices and Controls in the Portfolio Perspective

Module 6: Apply the ‘Programme’ Perspective and its Related Practices and Controls, Including Integrating Risk Management Across Perspectives, and the Related Roles

Typical Roles in the Programme Perspective

Related Practices and Controls in the Programme Perspective

Module 7(a): Apply the ‘Project’ Perspective and its Related Practices and Controls, Including Integrating Risk Management Across Perspectives, and the Related Roles

Typical Roles in the Project Perspective

Related Practices and Controls in the Project Perspective

Module 7(b): Describe How Risk Management is Influenced by Different Modes of Delivery

Linear/Sequential Project Delivery Mode

Iterative/Agile Project Delivery Mode

Hybrid Project Delivery Mode

Continual Improvement

Module 8: Apply the ‘Product’ Perspective and its Related Practices and Controls, Including Integrating Risk Management Across Perspectives, and the Related Roles

Typical Roles in the Product Perspective

Related Practices and Controls in the Product Perspective

Module 9: Apply the ‘Operational’ Perspective and its Related Practices and Controls, Including Integrating Risk Management Across Perspectives, and the Related Roles

Typical Roles in the Operational Perspective

Related Practices and Controls in the Operational Perspective

Unit 3: Understand How People and Culture Influence Effective Risk Management

Module 1: Describe Why and How People and/or Cultural Considerations Influence Risk Management

Overview of People Considerations

Module 2(a): How Engaging Stakeholders Ensures Effective Risk Management

Engaging Stakeholders

Module 2(b): How to Address Decision Biases

Working with Decision Bias

Module 2(c): How Individual Competence Creates and Combats Bias in Risk-Based Decision-Making

Building Individual Competence

Module 3: Analyse How the Aspects of Risk Culture Influence Effective Risk Management

Shaping a Supportive Risk Culture

Module 4: Assess How to Establish or Contribute to the Right Risk Culture

Overcoming Common Challenges in Application

Unit 4: How to apply the 8 Processes of Risk Management

Module 1: Describe the Purpose and Objectives of Each Process

Define Context and Objectives

Identify Threats and Opportunities

Prioritise Risks

Assess Combined Risk Profile

Plan Responses

Agree Contingency

Monitor and Report Progress

Review and Adapt

Module 2: Apply the ‘Define the Context and Objectives’ Process, Demonstrating an Understanding

Activities

Techniques

Documents to Support the Process

Focus of Key Roles for the Process

Module 3: Apply the ‘Identify Threats and Opportunities’ Process, Demonstrating an Understanding

Activities

Techniques

Documents to Support the Process

Focus of Key Roles for the Process

Module 4: Apply the ‘Prioritise Risks’ Process, Demonstrating an Understanding

Activities

Techniques

Documents to Support the Process

Focus of Key Roles for the Process

Module 5: Apply the ‘Assess Combined Risk Profile’ Process, Demonstrating an Understanding

Activities

Techniques

Documents to Support the Process

Focus of Key Roles for the Process

Module 6: Apply the ‘Plan Responses’ Process, Demonstrating an Understanding

Activities

Techniques

Documents to Support the Process

Focus of Key Roles for the Process

Module 7: Apply the ‘Agree Contingency’ Process, Demonstrating an Understanding

Activities

Techniques

Documents to Support the Process

Focus of Key Roles for the Process

Module 8: Apply the ‘Monitor and Report Progress’ Process, Demonstrating an Understanding

Activities

Techniques

Documents to Support the Process

Focus of Key Roles for the Process

Module 9: Apply the ‘Review and Adapt’ Process, Demonstrating an Understanding

Activities

Techniques

Documents to Support the Process

Focus of Key Roles for the Process

What’s included in this MoR® 4 Practitioner Risk Management Certification?

- Expert-led Training Sessions by Certified Instructors

- MoR® 4 Practitioner Risk Management Certification Exam

- Digital Delegate Pack

What You’ll Learn in this Course

This course takes you from understanding the fundamentals of MoR® 4 Risk Management to applying structured risk practices across organisational projects and operations. Each module strengthens your ability to identify, assess, and control risks while enhancing decision-making and resilience.

Learn the core principles and framework of risk management.

Learn how to identify, analyse, and evaluate different types of risk.

Learn to plan effective risk responses and mitigation strategies.

Learn to apply MoR® 4 practices across strategic, programme, and project levels.

Learn to monitor, review, and continuously improve risk processes.

Learn how to align risk management with organisational objectives and governance. standards.

MoR® 4 Practitioner Risk Management Certification Exam Information

The MoR® 4 Practitioner Risk Management exam is a professional certification exam that tests your knowledge and understanding of the MoR® methodology. It is designed for anyone who wants to demonstrate their expertise in using MoR® to manage organisational change. The following information showcases the structure of the MoR® 4 Practitioner Risk Management.

Question Type: Objective Testing

Total Questions: 65

Total Marks: 65 Marks

Pass Mark: 50%, 33/65 Marks

Duration: 2 Hours and 15 Minutes

Type: Open Book

Our Upcoming Batches

No schedules available.

No data available

No schedules available.

Request More Information

Corporate Training

Elevate your workforce with expert-led corporate training that enhances skills, boosts productivity, and aligns teams with your business goals.

Individuals Training

Unlock personal growth and sharpen professional skills with tailored training designed to build your confidence and career success.

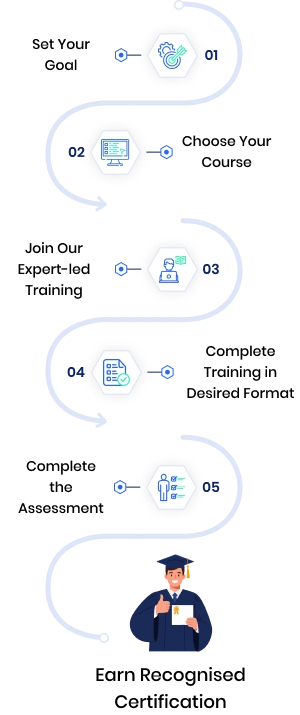

Your Path to Professional Recognition

Our path is designed to guide you through each stage with clarity, support and practical learning, helping you achieve your goals with confidence.

Step Forward with Globally Recognised Certification

A recognised certification is more than a credential. It’s proof of your commitment to professional excellence, providing you with the credibility, confidence, and global reach to advance your career in exciting new directions.

Globally Certified Professionals Over Time

Career Growth

81%Certified professionals reported receiving a promotion after earning their certification.

Global Opportunities

89%Certified professionals experienced access to new career opportunities, including leadership roles and global positions.

Not able to find what you are looking for

Our experts will guide you to the right course from thousands worldwide: tailored to your goals.

Frequently Asked Questions

The MoR® 4 Practitioner Risk Management Certification validates your ability to apply structured risk management practices using the latest MoR® framework. It equips professionals to identify, assess, and control risks across projects, programmes, and strategic operations.

This course is ideal for Project Managers, Risk Specialists, Auditors, and Business Leaders involved in strategic decision-making. It’s also suitable for professionals who have completed the MoR® Foundation level and want to advance their practical application skills.

To sit the MoR® 4 Practitioner exam, you must first pass the MoR® 4 Foundation exam. A solid understanding of the MoR® principles, framework, and terminology is essential to successfully complete the Practitioner level.

The exam includes 65 objective-testing questions to be completed within 2 hours and 15 minutes. The pass mark is 50% (33 out of 65), and it is open book, allowing the use of the official MoR® guide during the assessment.

This certification helps professionals develop a consistent approach to managing risks, improving decision-making, and ensuring organisational resilience. It also enhances employability and credibility in risk management and project governance roles worldwide.

What Our Customers Say About Us

Matthew Sullivan

HR Business Partner

Matthew Sullivan

HR Business Partner

Our HR team registered for the Change Management Foundation & Practitioner Training Course, and it couldn’t have been more valuable. The team gained practical frameworks to guide employees smoothly through transitions with confidence.

Olivia Barrett

Operations Manager

Olivia Barrett

Operations Manager

Our operations staff completed the Lean Six Sigma Green Belt Training Course, and it has been transformative. We can now identify inefficiencies quickly, and the tools we learned are already improving performance across the team.

Benjamin Foster

Product Manager

Benjamin Foster

Product Manager

Our product team took part in the Agile Project Management Foundation & Practitioner (AgilePM®) Training Course, and the difference is remarkable. We’re now more adaptive, collaborative, and efficient in managing change.

Lucy Harper

IT Support Lead

Lucy Harper

IT Support Lead

Our IT support unit attended the ITIL® 4 Foundation Training Course, and the results have been impressive. Processes are smoother, collaboration has improved, and the team finally speaks a common language of service management.

Edward Clarke

Programme Manager

Edward Clarke

Programme Manager

We joined the PMP® Certification Training Course as a leadership group, and it was outstanding. The trainer made every concept practical, and the exam preparation resources helped the whole team feel ready to tackle complex projects.

Amelia Rhodes

Project Officer

Amelia Rhodes

Project Officer

Our project office completed the PRINCE2® Foundation & Practitioner Training Course, and it has brought real clarity to how we manage projects. The trainer’s examples were excellent, and the team now follows a structured approach with confidence.